Jack & The Soybean Stalk

Money managers aren’t expecting much deviation from the bearish tone influenced in part by poor export demand that has plagued the agricultural market for the past 2 years, but recent positioning and fundamentals imply a climb back into positive territory.

Thesis

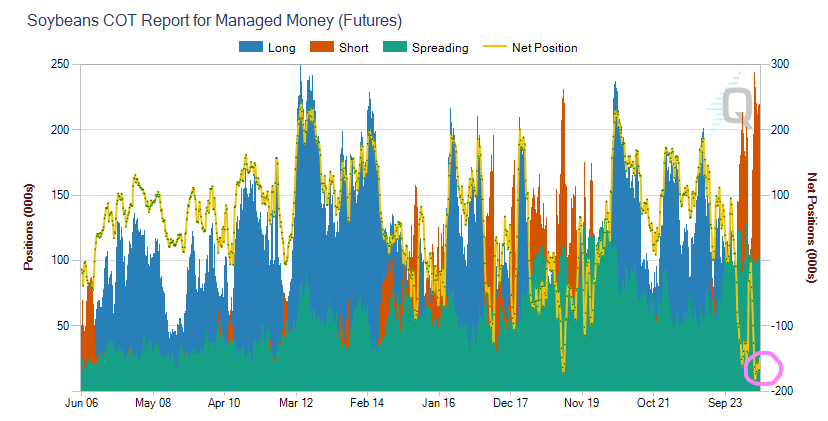

Speculators cut net short in futures/options to a 9 week low, with a slight reduction in longs. Short covering seen through the week was split between shorts covering and new longs being put on.

This is the largest net short position in history and is likely just the beginning of a potential squeeze.

In contrast to past demand, recent flurry of export demand from China has been reflected in the spread of the cash market over the November contract. It has gone into backwardation reflecting strong current demand.

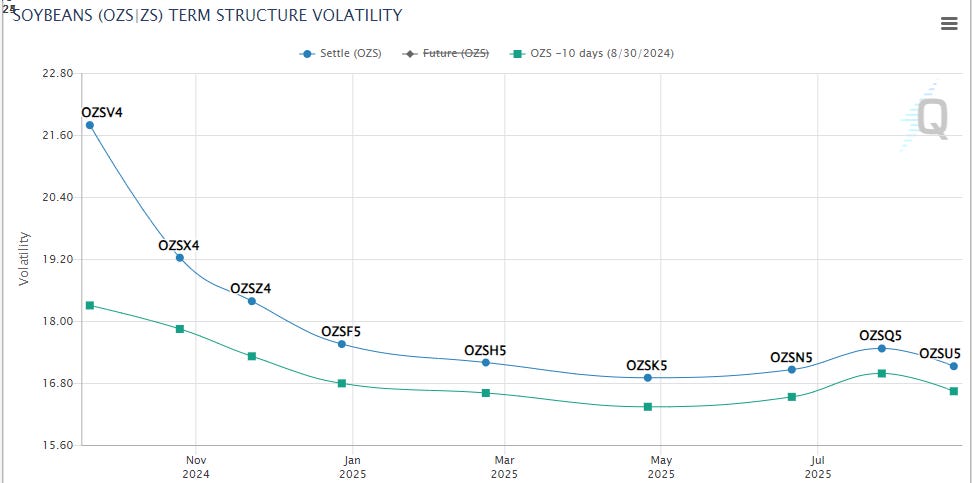

The market’s expectation for a record setting crop is already reflected in the current price therefore there is a bigger risk for shorts because any glimmer of hope this week will result in more short covering.

At the same time, longs will be insulated somewhat from a positive data print as bullish supply conditions are already baked in as previously mentioned.

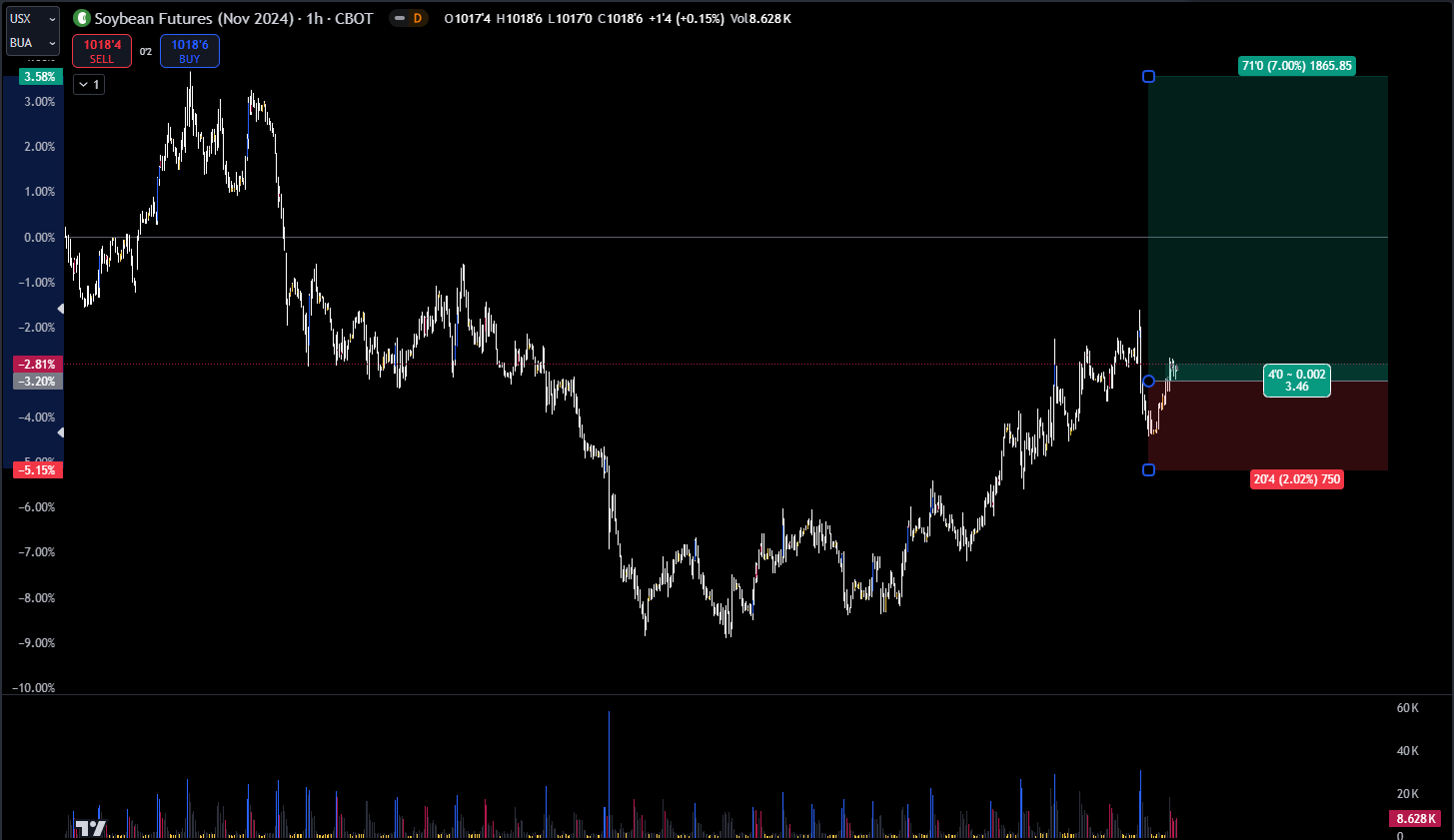

We opened a position on the November contract and signaled it via Twitter on Sept 8. Our thesis on buying the Friday dip was correct and is currently onsides.

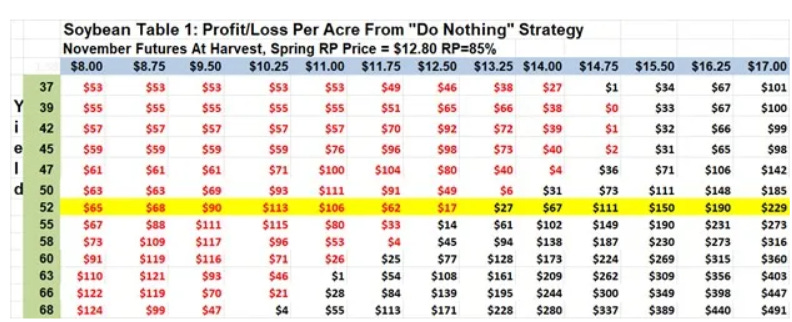

Based on the table below, there’s no incentive to grow beans below $10.25.

Would you be long an asset recovering off the lows where demand has surprised to the upside while bearish supply expectations are largely built into the current price?

If yes, here’s the current risk/reward for you:

In order for soybeans to trade lower, there needs to be a real change in fundamentals.

We will update any changes in the trade. Thanks for reviewing.